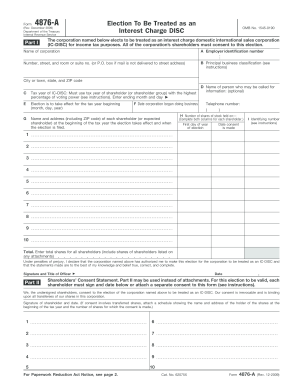

IRS 4876-A 2016-2025 free printable template

Instructions and Help about IRS 4876-A

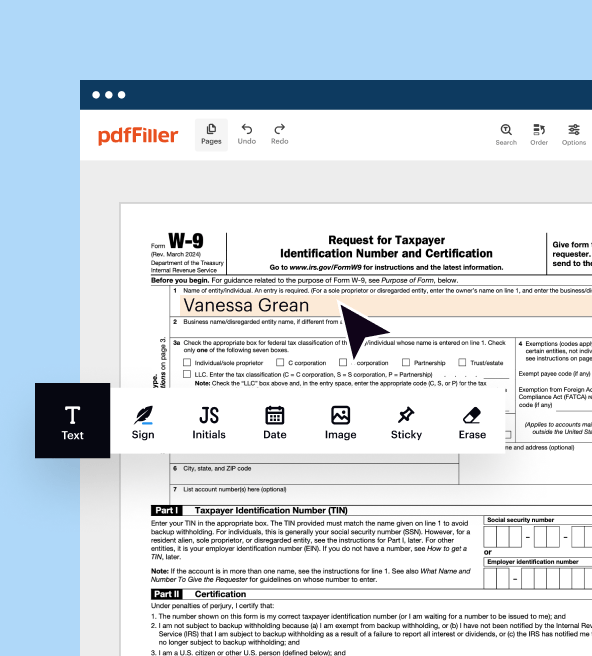

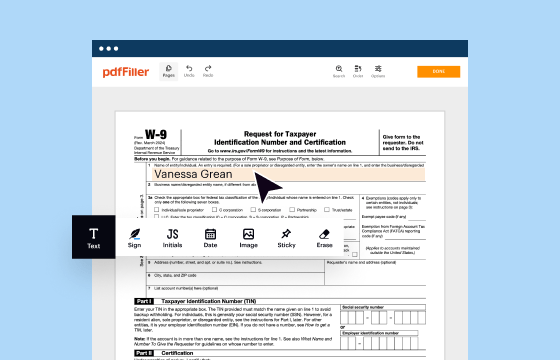

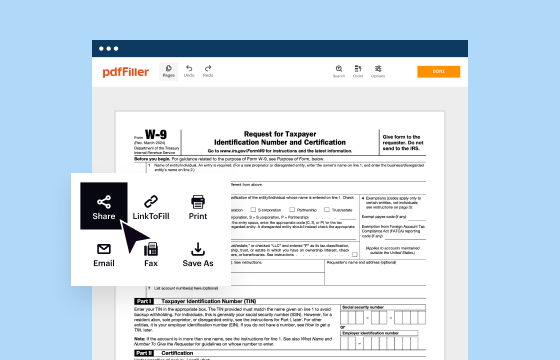

How to edit IRS 4876-A

How to fill out IRS 4876-A

Latest updates to IRS 4876-A

All You Need to Know About IRS 4876-A

What is IRS 4876-A?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

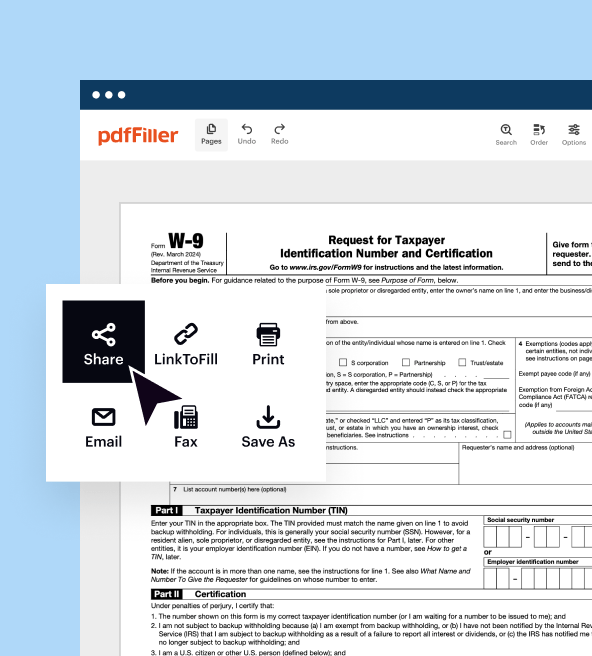

Where do I send the form?

FAQ about IRS 4876-A

What should you do if you realize there’s an error after submitting IRS 4876-A?

If you discover an error after submitting IRS 4876-A, you should submit an amended form to correct the mistakes. Ensure that you clearly indicate the changes made to avoid confusion. Keep a copy of the amended filing for your records and verify that the IRS acknowledges receipt of the corrected form.

How can you verify the status of your IRS 4876-A submission?

You can verify the status of your IRS 4876-A submission by checking the IRS online portal or by calling the IRS helpline for updates. Have your submission details on hand to facilitate the inquiry. Tracking your submission helps ensure that you stay informed about any processing issues or requirements.

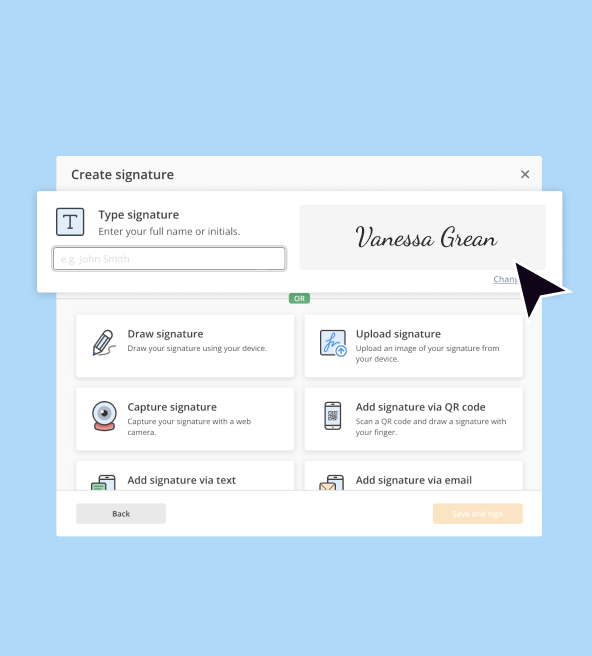

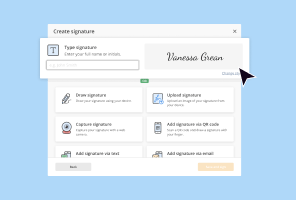

Are e-signatures acceptable for IRS 4876-A filings?

Yes, e-signatures are acceptable for IRS 4876-A filings, making the submission process more convenient. Ensure that your e-signature is compliant with IRS standards to avoid any potential rejections. Retain confirmation of your e-filing as proof for your records.

What should you do if you get a notice from the IRS after filing IRS 4876-A?

If you receive a notice from the IRS after filing IRS 4876-A, carefully review the letter for specific instructions or issues raised. Prepare any necessary documentation to respond adequately and ensure that you meet any deadlines mentioned in the notice. If needed, seek assistance from a tax professional to handle the situation effectively.

What common errors occur when filing IRS 4876-A and how can you avoid them?

Common errors when filing IRS 4876-A include incorrect entry of payment amounts and missing signatures. To avoid these mistakes, double-check all entries before submission and ensure that all required information is provided and accurate. Utilizing software that checks for common errors can also help streamline the filing process.