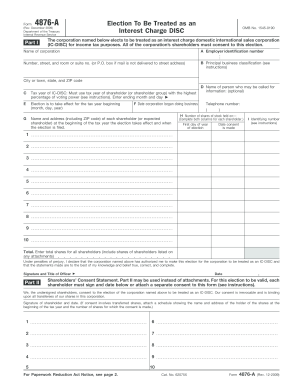

IRS 4876-A 2016-2025 free printable template

Get, Create, Make and Sign ic disc no loss rule form

How to edit form 1120 ic disc instructions online

IRS 4876-A Form Versions

How to fill out form 4876 a

How to fill out IRS 4876-A

Who needs IRS 4876-A?

Video instructions and help with filling out and completing ic disc irs

Instructions and Help about ic disc dividends

Hello guys welcome back to my channel so for today's video tutorial 485 or adjust tattoos, so this is 4k one so hope you like this video please subscribe to my channel so let's start, so this is the form i-485 or application to register permanent residence or adjust status so this part for us to as use only so skip this part so here we're going to start here part one information about you person applying for local permanent residence your current legal name do not provide the nickname so here if you're already married, so you're going to adjust that provide your family name here since you're already married yeah I put my husband's last name here so see that given name your given name and then your middle name, so this is my middle name when I was single then here other names you have used since birth if applicable no provide all other names you have ever used including your family name at work other legal names nicknames aliases and assume names if you need extra space to complete this section use the space providing fire reporting additional information so here provide your single name your...

People Also Ask about form instructions 4876

What is the form 4876 a election to be treated as an interest charge disc?

What is the form 4876-a election to be treated as an interest charge disc?

What is 1120-IC-disc?

Where to mail Form 56 Notice Concerning fiduciary Relationship?

Where to file Form 4876-A?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit irs form 1120 ic disc from Google Drive?

Can I sign the ic disc rules electronically in Chrome?

How do I fill out the ic disc instructions form on my smartphone?

What is IRS 4876-A?

Who is required to file IRS 4876-A?

How to fill out IRS 4876-A?

What is the purpose of IRS 4876-A?

What information must be reported on IRS 4876-A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.